China Isn’t Overtaking America

Twenty-first century rivalry between the United States and China will be as much about economic might as military power.

Twenty-first century rivalry between the United States and China will be as much about economic might as military power.

China has become shrill in its criticism of the fiscal train wreck in the United States, arguing that the answer to a potential government default is to begin creating a “de-Americanized world.”

Bill Bishop:

The D.C. dysfunction puts China in a difficult place. Any financial markets turmoil that occurs because of a failure of Congress to do its job could harm China’s economy, and especially its exports. The accumulation...

One day after Republican House Speaker John Boehner promised to “stand and fight” over the budget, Chinese officials pleaded with America’s deadlocked Congressmen to stand down, because otherwise China, the U.S.’s biggest creditor, will be...

Foreign investors that specialise in buying up distressed debt are queuing outside the industry's door, but bankers say China's reluctance to pay the price of a privately funded clean-up means that door probably won't open....

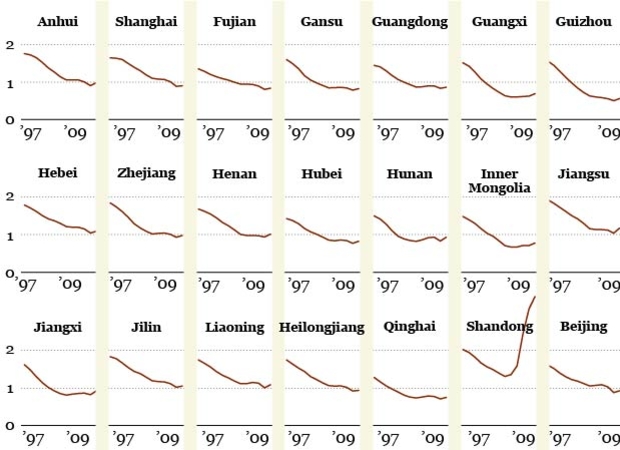

China leads the world in infrastructure investment. The new roads, new railroads, new skyscrapers, even whole new cities that seem to spring into existence every day leave little doubt that investment has been ambitious. But has it been wise?...

China will start a nationwide audit of government debt this week as the new Communist Party leadership investigates the threats to growth and the financial system from a record credit boom. The State Council, under Premier Li Keqiang, ordered the...

Local government debt is now so unwieldy in China that some desperate city governments, such as that of western Ordos, have turned to the private sector for help to pay their employees.

Warning of local governments’ high exposure to bad debts, the credit agency Fitch recently downgraded China’s long-term local-currency rating from AA– to A+. Officials should take note: the downgrade underlines how closely international markets...

Financial crises in the 1930s and 1970s showed the world that economic instability results when demand for international liquidity allows a small number of countries to run up massive debts in their own currencies. Named for the economist who...

Given its relatively low savings rate, the U.S. economy depends heavily on foreign capital inflows from countries with high savings rates (such as China) to meet its domestic investment needs and to fund the federal budget deficit. The...